-

+65 85113734

-

bd@ridik.net

LOS

LENDING ORIGINATION SYSTEM (LOS)

TO FACILITATE DIGITAL TRANSFORMATION FOR BANKS

Digital transformation is taking a toll on traditional banks. In scenarios that are difficult for traditional banks to cover, virtual banks use their data and technology advantages to gain more clients. In response, traditional banks have increased their investments in utilizing innovative technologies to keep up with the online banking trend, particularly as people have started adjusting to the ‘new normal’ brought by the pandemic. A strategy such as this involves the adoption of new product designs and the gradual transformation of legacy system without affecting the operation as a whole, in order to meet future system updates and development.

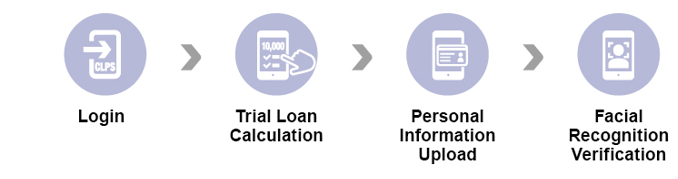

System Cycle

Features

Flexible Application Processing

Centralized Management Process

Utilized advanced technologies (Face ID, OCR, RPA, Blockchain)

Credit Scoring

Seamless implementation with existing system

Rule-based engine for compliance process

Blockchain-based document verification